2012 News Releases

January 12, 2012

Goldgroup Announces Additional Positive Drill Results at Caballo Blanco

DDH 11 CBN 142: 69.60 m @ 0.97 g/t Au

DDH 11 CBN 143: 93.90 m @ 0.77 g/t Au

DDH 11 CBN 145: 75.85 m @ 0.65 g/t Au

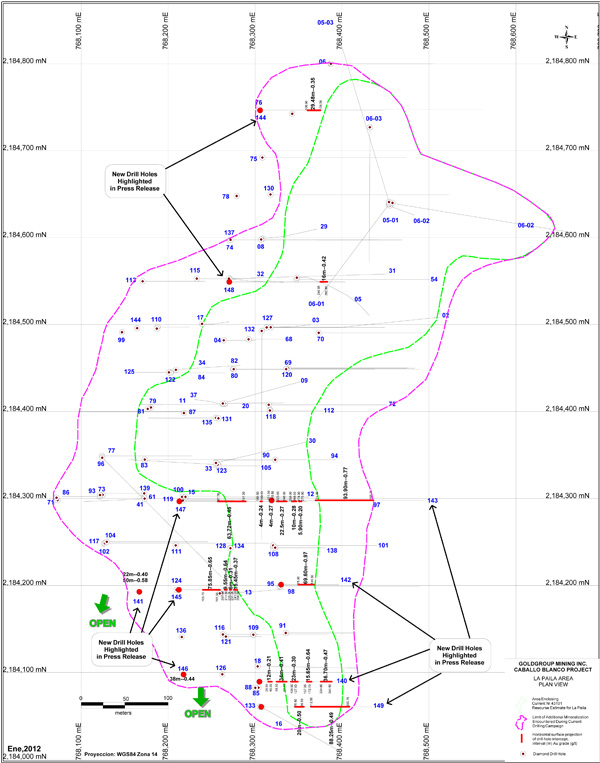

Vancouver, British Columbia (January 12, 2012) - Goldgroup Mining Inc. ("Goldgroup" or the "Company") (TSX:GGA) is pleased to announce that additional drill holes at the Company's 100%-owned Caballo Blanco gold project in Veracruz, Mexico have yielded significant gold intercepts, expanding the La Paila oxide gold zone to the southwest. All ten drill holes reported below (see Tables 1 and 2 and the drill hole location map) are part of the ongoing diamond drilling program to define the La Paila Zone at Caballo Blanco. Of the ten drill holes reported below, eight of these drill holes were used to expand the southwestern flank of the La Paila Zone, as the zone currently remains open in this direction.

Keith Piggott, President and CEO of Goldgroup, stated, "All of these diamond drill results at the La Paila Zone yielded significant gold intercepts above the cut-off grade, which are contained in completely oxidized, vuggy and siliceous rock occurring within and peripheral to the zone. These results continue to give better definition to the design of the first open pit. As planned, the 2011 drilling program was completed on December 18, 2011. In 2012, the Company is planning a drill program of up to 30,000 metres to further delineate the Caballo Blanco mineral resource."

The Company focused its 2011 drilling program primarily on the La Paila Zone, specifically with the objectives of designing the first open pit and updating the current NI 43-101 mineral resource estimate for Caballo Blanco, which is expected to be released in the first quarter of 2012. In addition, in-house and consultant engineering have significantly advanced Goldgroup's column leach testing in its large on-site facility and progressed leach pad and carbon recovery plant design. The drilling and infrastructure work, combined with the anticipated upcoming updated NI 43-101 mineral resource estimate, will form the basis of a preliminary economic assessment (PEA) expected to be completed on the Caballo Blanco project in the first quarter of 2012. The current drilling program, together with the on-going column-leach metallurgical testing, environmental and sociological studies as well as the run of mine heap-leach pad design and other engineering, form the basis for targeting to bring Caballo Blanco into production by 2012 year-end.

As part of Goldgroup's 2012 drilling program, the Company expects to continue drill testing in the La Paila Zone, in addition to drill testing a number of geochemical and geophysical targets in the large Northern Zone ring structure beyond the La Paila Zone. In addition, the Company intends to drill targets in the Highway Zone, which is located approximately seven kilometres to the southeast of the Northern Zone.

Table 1. Drill-Hole Results for the Caballo Blanco Project, Mexico

| DIAMOND DRILLING - LA PAILA ZONE | ||||

|---|---|---|---|---|

|

Diamond Drill Hole |

Mineralization |

|||

|

From (m) |

To (m) |

Interval (m) |

Au grade (g/t) |

|

|

11 CBN 140 |

28.50 |

40.50 |

12.00 |

0.21 |

|

And |

56.50 |

90.50 |

34.00 |

0.41 |

|

And |

104.50 |

127.50 |

23.00 |

0.30 |

|

And |

157.05 |

172.70 |

15.65 |

0.64 |

|

And |

204.80 |

241.50 |

36.70 |

0.47 |

|

11 CBN 141 |

78.50 |

100.50 |

22.00 |

0.40 |

|

And |

254.50 |

304.50 |

50.00 |

0.58 |

|

11 CBN 142 |

75.90 |

145.50 |

69.60 |

0.97 |

|

11 CBN 143 |

71.30 |

165.20 |

93.90 |

0.77 |

|

11 CBN 144 |

108.90 |

138.38 |

29.48 |

0.35 |

|

11 CBN 145 |

105.70 |

181.55 |

75.85 |

0.65 |

|

And |

201.95 |

211.50 |

9.55 |

0.64 |

|

And |

225.05 |

231.05 |

6.00 |

0.31 |

|

And |

241.05 |

256.50 |

15.45 |

0.37 |

|

11 CBN 146 |

201.50 |

239.50 |

38.00 |

0.44 |

|

11 CBN 147 |

87.78 |

151.50 |

63.72 |

0.46 |

|

And |

185.50 |

189.50 |

4.00 |

0.24 |

|

And |

211.50 |

215.50 |

4.00 |

0.27 |

|

And |

223.50 |

246.00 |

22.50 |

0.27 |

|

And |

258.00 |

268.00 |

10.00 |

0.28 |

|

And |

274.00 |

279.90 |

5.90 |

0.20 |

|

11 CBN 148 |

246.85 |

262.85 |

16.00 |

0.42 |

|

11 CBN 149 |

76.50 |

96.50 |

20.00 |

0.50 |

|

And |

112.50 |

200.75 |

88.25 |

0.49 |

For a drill hole location map, click here.

All of the holes presented above intersected gold mineralization in excess of the 0.2 g/t Au cut-off grade used in the current Caballo Blanco NI 43-101 technical report which is available on SEDAR. However, it is expected that as a result of favourable leach kinetics, recovery and ease of mining, a lower cut-off grade may be applicable.

A complete summary of the assay results from diamond drill holes DDH 11 CBN 140 to DDH 11 CBN 149, as well as a drill-hole location map of the La Paila Zone detailing the relative locations of the drill holes will be posted on Goldgroup's website atwww.goldgroupmining.com/s/caballoblanco.asp.

Table 2. Drill Hole Location Data, Caballo Blanco Project, Mexico

| DD Hole Number | East UTM Coord (metres) | North UTM Coord (metres) |

Elevation (m.a.s.l) |

Azimuth (degrees) |

Plunge (degrees) |

Total Length (metres) |

|---|---|---|---|---|---|---|

| 11 CBN 140 | 768305 |

2184089 |

497 |

090 |

-70 |

241.5 |

| 11 CBN 141 |

768167 |

2184193 |

536 |

000 |

-90 |

338.0 |

| 11 CBN 142 |

768330 |

2184201 |

488 |

090 |

-75 |

256.5 |

| 11 CBN 143 |

768319 |

2184298 |

489 |

090 |

-45 |

250.5 |

| 11 CBN 144 |

768306 |

2184746 |

477 |

090 |

-60 |

284.7 |

| 11 CBN 145 |

768212 |

2184195 |

515 |

090 |

-75 |

268.5 |

| 11 CBN 146 |

768218 |

218409 |

543 |

000 |

-90 |

319.5 |

| 11 CBN 147 |

768213 |

2184297 |

511 |

090 |

-60 |

290.5 |

| 11 CBN 148 |

768270 |

2184549 |

505 |

090 |

-65 |

314.5 |

| 11 CBN 149 |

768307 |

2184060 |

497 |

090 |

-60 |

253.5 |

About Caballo Blanco

Goldgroup owns 100% of the Caballo Blanco gold project which consists of a series of oxide gold zones located in the State of Veracruz in eastern Mexico. The principal known gold zone at Caballo Blanco is the La Paila prospect located within a cluster of high-sulphidation epithermal alteration zones referred to as the Northern Zone. The current NI 43-101 mineral resource estimate for the La Paila Zone was compiled from 32 diamond drill holes totalling approximately 7,000 metres completed by NGEx Resources Inc., prior to Goldgroup's acquisition of its interest in the project in November 2009. This mineral resource estimate consists of 139,000 ounces of gold (6.7 million tonnes grading 0.65 g/t Au) contained in the category of indicated resources and 517,000 ounces of gold (27.6 million tonnes grading 0.58 g/t Au) contained in the category of inferred resources.

Subsequently, Goldgroup diamond drilled an additional 120 holes at the La Paila Zone in 2011 and received assays for 80 holes totalling approximately 30,000 metres. These drill holes are expected be used to update the NI 43-101 mineral resource estimate in the first quarter of 2012.

Other known gold zones at Caballo Blanco occur to the northeast of the La Paila Zone and approximately seven kilometres to the southeast of the Highway Zone. These gold zones together with geophysical anomalies in the Northern Zone ring structure are expected to be drill tested.

Assaying and Qualified Person

After project geologists logged and marked the core, technicians cut the individual lengths with a diamond saw, then tagged the bags and secured them with security clips. The samples were then collected by ALS Minerals and transported to their Guadalajara preparation facility where they were dried and crushed to -2mm. A 250 gram split of the coarse material was then pulverized to -200 mesh. The rejects remained at the prep facility and the pulps were air couriered to ALS Minerals North Vancouver facility and analyzed for gold by 30g fire assay with an AA finish. In addition, a 35 element ICP analysis was conducted on all samples. A QA/QC program was implemented as part of the sampling procedure for the drill program. One standard, one blank or one duplicate was inserted per group of ten samples sent to the laboratory. The information in this news release has been approved by Marc Simpson, P. Geo., the Company's Qualified Person under National Instrument 43-101 standards.

About Goldgroup

Goldgroup is a well-funded Canadian-based gold production and exploration Company with significant upside in a portfolio of projects in Mexico, including its flagship 100%-owned advanced stage gold development project, Caballo Blanco, in Veracruz, and the 50%-owned high grade gold exploration project, San José de Gracia, in Sinaloa. The Company operates the 100%-owned Cerro Colorado gold mine in Sonora, Mexico.

Goldgroup is led by a team of highly successful and seasoned individuals with extensive expertise in mine development, corporate finance, and exploration in Mexico. Goldgroup's mission is to grow gold production, mineral resources, profitability and cash flow, building a leading gold producer in Mexico.

For further information on Goldgroup, please visit www.goldgroupmining.com or contact:

Keith Piggott, President & CEO

T: 604-682-1943

Stephanie Batory, Investor Relations

Toll Free: 1-877-655-ozAu (6928)

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION